Low Repo Rate and Reverse Repo Rate. Banks are always happy to lend money to the BB since their money is in safe hands with a good interest.

What Is A Repurchase Agreement Repo By Farhad Malik Fintechexplained Medium

Repo Rate Vs Reverse Repo Rate Definition Significance Effects

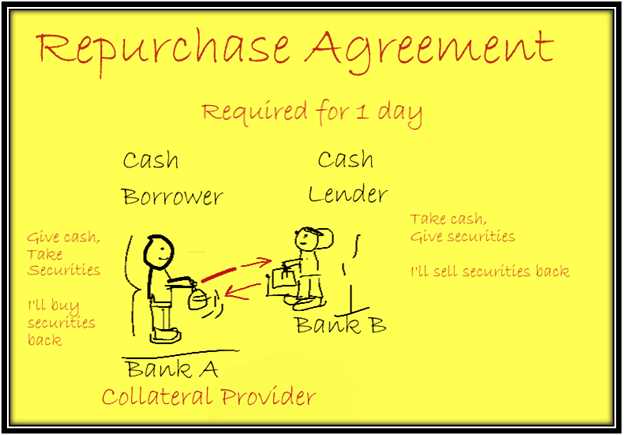

1 What Is A Repo

What is the Repo Rate and Reverse Repo Rate Currently.

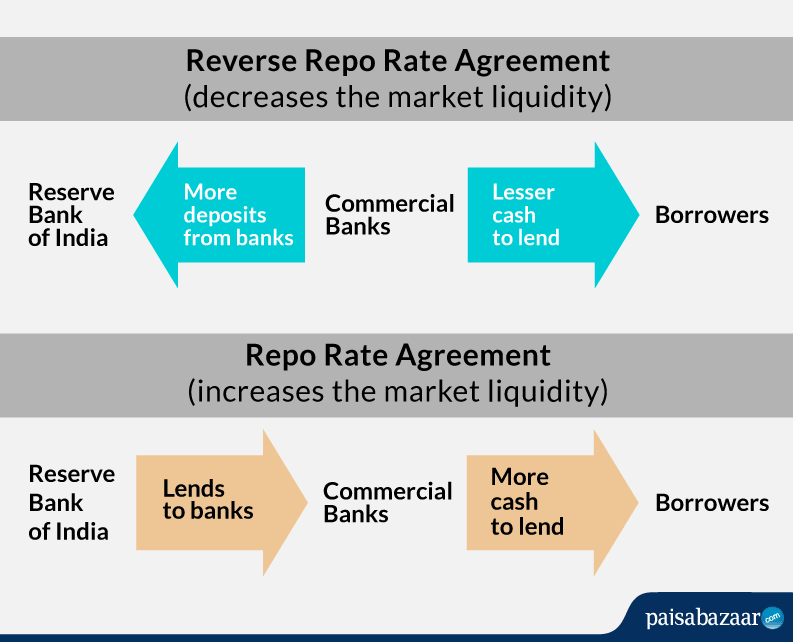

Repo and reverse repo. Bank lending rates are impacted by repo rate and reverse repo rate. An increase in reverse repo rate can prompt banks to park more funds with the central bank to earn higher returns on idle cash. Repo and reverse repo are the monetary measures used by the Reserve Bank of India to deal with the deficiency of funds and liquidity in the market.

The basic differences between reverse repo rate and repo rate are as follows. When the Reverse Repo Rate is also low banks park less money into the central bank as it generates low returns. Repos and reverse repos are used for short-term borrowing and lending often overnight.

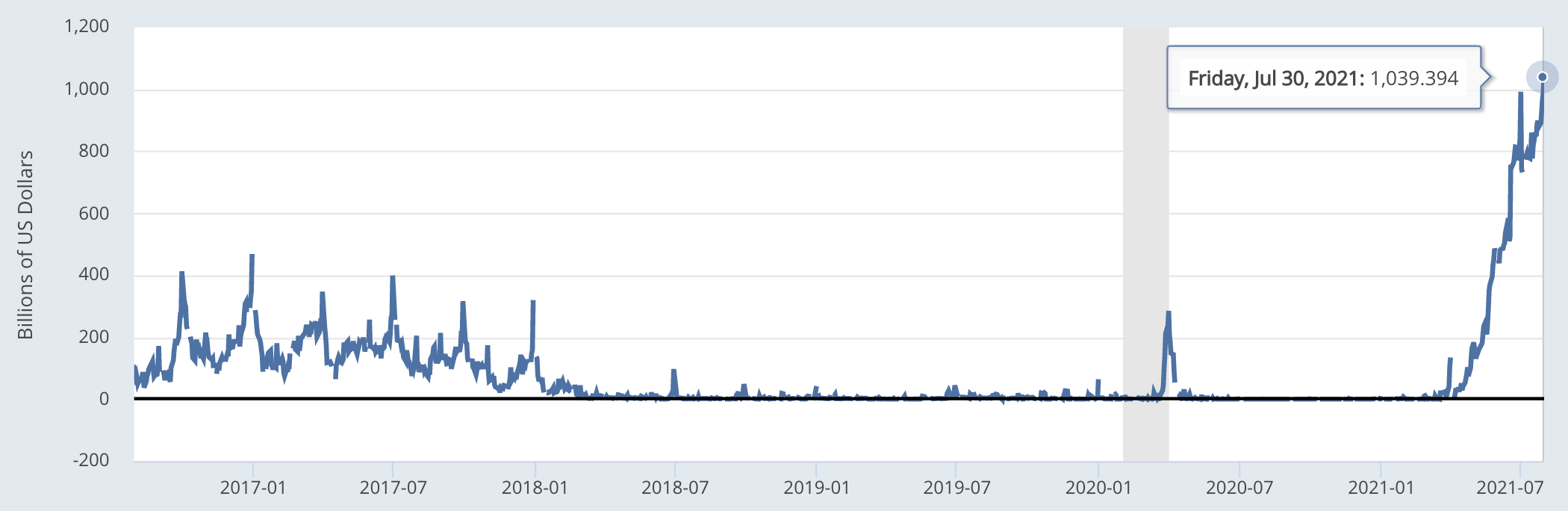

If it raises that rate it raises all interest rates in the economy since they are all based on the zero risk. Difference between Reverse repo rate and Repo rate. The New York Feds Open Market Trading Desk the Desk is authorized by the Federal Open Market Committee FOMC to conduct repurchase agreement repo and reverse repo transactions.

The party that is selling securities is doing a Repo and the party that is buying securities is doing Reverse Repo. To conclude the major difference between these two is that an increase in the repo rate will make commercial banks borrow less. When sources of capital like money market funds decide where to park their money they might choose between the Feds reverse repo account and a commercial bank where their money will end up in a reserve account.

Any repo income expenditure for the remaining period should be reckoned for. The current repo rate is 400 while the reverse repo rate is 335. These open market operations support effective monetary policy implementation and smooth market functioning by helping maintain the federal funds fed funds rate within the FOMCs target range.

As of the August 2020 Monetary Policy Committee meeting the RBI has maintained the rates without any change. Additionally repos and reverse repos are often carried out by the Federal Reserve in order to temporarily provide liquidity to or remove liquidity from the financial system to support implementation of monetary policy and to promote financial stability. The Federal Reserve has multiple accounts including reserve accounts for commercial banks as well as the reverse repo account.

Repo rate is used to control inflation and reverse repo rate is used to control the money supply. Repurchase Agreements Repo Reverse Repurchase Agreements Reverse Repo Explained in One Minute - YouTube. Central banks use reverse repos to add money to the money supply via open market operations.

The relationship between the Reverse Repo rate Repo rate and Bank rate MSF. What is Reverse Repurchase Agreement Reverse Repo. As we have understood Repo rate is the interest rate at which RBI lends and Reverse Repo rate is the interest rate which a bank will get for parking its money with RBI against Govt.

However some argue that use of repos can lead to. This process is. When the Repo Rate is low banks borrow more money from the Central Bank because the cost of borrowing is low.

The reverse repo rate is always lower than the repo rate. A high reverse repo rate dries up the money supply while a high repo rate results in injecting more liquidity in the system. Repo reverse repo transactions outstanding on the balance sheet date only the accrued income expenditure till the balance sheet date should be taken to the Profit and Loss account.

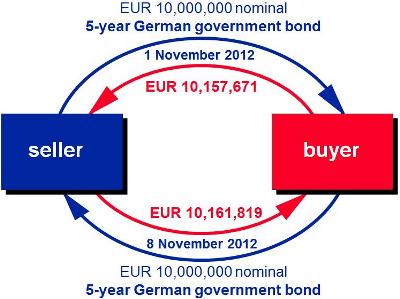

A reverse repurchase agreement RRP is an act of buying securities with the intention of returning or reselling those same assets back in the future at a profit. The Reverse Repo Reverse Repurchase Agreement is the same agreement as Repo but viewed from the lenders perspective its a purchase of securities with an obligation to resell them at a greater price at a specific future date. The repo rate is always higher than the reverse repo rate.

A Reverse Repurchase Agreement is also called reverse repo which brings into the implementation of an agreement between a buyer and seller stating that that the buyers of the securities who purchased any kind of securities or assets have the right to sell them at a higher price in the future ie the seller who has to accept the higher price in the future. It is a vital money flow control mechanisms used by the central bank. Reverse Repo rate is the rate at which the central bank borrows money from commercial banks.

Operation results include all repo and reverse repo operations conducted including small value exercises. Reverse Repo allows the Fed to set a floor on the interest rates in the economy. Essentially repos and reverse repos are two sides of the same coinor rather transactionreflecting the role of each party.

A reverse repurchase agreement known as reverse repo or RRP is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. The New York Fed conducts repo and reverse repo operations each day as a means to help keep the federal funds rate in the target range set by the Federal Open Market Committee FOMC. A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group of securities for a specified period.

The key difference between the two types of operations are that while repo operations add liquidity to the financial system by providing institutions with cash reverse repo operations instead remove liquidity from the system. Now in this scenario Reverse Repo rate will always be less than the Repo rate. Both these rates experienced at 40 basis point cut on 22 May 2020.

Why Demand For Fed S Reverse Repo Facility Is Surging Again Marketwatch

Fed Drains 351 Billion In Liquidity From Market Via Reverse Repos As Banking System Creaks Under Mountain Of Reserves Wolf Street

Bitcoin Rises As Reverse Repos Hit 1 Trillion Trustnodes

2

What Is Reverse Repo Rate Youtube

Fed S Reverse Repos Hit 503 Billion Liquidity Drain Undoing Over 4 Months Of Qe Wolf Street

Repo And Reverse Repo Accounting Education

Reverse Repo Overnight Lending Chart May 28 2021 Update Ddintogme